Why Business Process Compliance is critical to meet regulatory requirements

Compliance is a vital aspect of any organization's operations. It refers to adherence to laws, regulations, standards, and guidelines that govern the organization. Compliance ensures that organizations operate ethically and responsibly, protecting their customers' and stakeholders' interests, while preserving their reputation to ensure business success.

In our globalized and intricate environment, the growing amount of legislation and regulation makes it difficult for organizations to stay updated with compliance requirements and their impact on business processes. At the same time, an organization requires a robust internal control environment to ensure its processes are efficient and secure to support the pursuit of business objectives.

In this context, it can be challenging for organizations to adapt their processes, policies, and procedures to keep pace with current and new compliance requirements.

Can anything be done to simplify the challenge of maintaining compliance in a dynamic business environment?

This article will discuss why business process compliances are critical in ensuring compliance and how organizations can effectively manage compliance requirements.

Understand business processes and operations to ensure compliance

Many organizations have siloed compliance requirements in scattered departments. Compliance officers, internal controllers, and internal auditors often use different systems, making it difficult for the organization to manage procedures and processes in such a disorganized system and architecture. Compliance in a dynamic business and regulatory environment requires a complete understanding of business processes, risks, and internal controls. It is processes that need to stay compliant and secure.

An organization can be fully intelligent about changing regulatory requirements but not in compliance with the laws if it fails to maintain its business processes to address changing requirements and adapt its policies, procedures, and control framework accordingly.

Reaching a 360° view of compliance

To meet and maintain the entirety of compliance requirements, the organization first needs complete situational awareness and holistic understanding throughout the enterprise of compliance requirements that can be scattered across systems, departments, processes, people, and data.

To complete this vision, an organization must also have full visibility of the risks associated with compliance requirements and the related controls that mitigate them to ensure that they are contained at acceptable levels in line with the company's risk appetite.

The importance of internal controls, although not solely dedicated to managing regulatory compliance, is essential as it provides unique insights to Compliance professionals regarding the organization's defense system status.

Compliance officers can easily leverage and integrate valuable information regarding the effectiveness of internal controls sourced by control owners into their compliance programs.

Ensuring Business Process Compliance

Organizations can ensure business process compliance by following a systematic approach that encompasses various components:

1. Assessing Compliance Requirements:

The first step towards ensuring business process compliance is thoroughly understanding the compliance requirements that apply to the organization. This involves conducting comprehensive compliance assessments and reviewing relevant laws, regulations, industry standards, and best practices. Organizations can effectively tailor their business processes to address these requirements by identifying specific compliance requirements.

2. Developing Policies and Procedures:

Once the compliance requirements are identified, organizations must develop robust policies and procedures that outline the necessary steps and controls to achieve compliance. These policies and procedures should be communicated to all employees, emphasizing the importance of compliance and the consequences of non-compliance.

3. Implementing Process Automation:

Process automation can significantly enhance business process compliance by reducing manual errors and ensuring consistency in compliance-related activities. Automation tools and software can streamline compliance processes, such as data collection, documentation, and reporting, enabling organizations to achieve compliance more efficiently and effectively.

4. Training and Awareness:

Training and awareness programs are essential to equip employees with the knowledge and skills to ensure compliance. Organizations should invest in regular training sessions and workshops to educate employees about compliance requirements, their roles and responsibilities, and best practices for achieving compliance.

5. Continuous Monitoring and Audit:

Continuous monitoring and auditing of business processes are crucial to ensure ongoing compliance. Internal and external audits should be conducted regularly to assess the effectiveness of compliance controls, identify areas for improvement, and address any non-compliance issues.

The Role of Compliance Professionals

Compliance professionals are vital in ensuring business process compliance within an organization. They are responsible for developing and implementing compliance programs, monitoring compliance across all business functions, and advising stakeholders on compliance issues. Compliance officers work closely with key stakeholders to create a compliance framework that aligns with the organization's goals and objectives.

Moreover, compliance professionals assist in change management efforts by evaluating the impact of new processes or changes in existing processes on compliance. They work with various departments to identify potential compliance risks associated with process changes and implement appropriate measures to maintain compliance during the transition period.

Effective compliance management is crucial for organizations to safeguard their reputation, protect stakeholders' interests, and achieve long-term success. Business processes form the foundation for ensuring compliance by integrating compliance requirements into everyday operations.

Organizations can effectively manage compliance risks by following best practices, utilizing process automation, and engaging compliance professionals to ensure their business processes comply with applicable laws, regulations, and industry standards.

Why are internal controls important in ensuring Compliance in an organization?

Internal control definition and objectives

Internal control, as defined by COSO, is broadly defined as a process, effected by an entity's governing body, management, and other employees, designed to provide reasonable assurance regarding the achievement of objectives regarding effectiveness and efficiency of operations, reliability of financial reporting, and compliance with applicable laws and regulations.

The role of internal control in Compliance

As stated above, the role and contribution of internal control in an organization is paramount in ensuring compliance status to cover up potential vulnerabilities to risk, such as fraud in the payable system, conflicts of interest, poor segregation of duties, etc... To that end, Internal control and Compliance usually work in pairs to ensure accurate reporting and compliance with laws, regulations, and policies. This joint effort also benefits Internal auditors by providing them with a shared vision of the compliance actions.

Adequate internal controls are, therefore, essential in achieving compliance and must be embedded in the organization's processes and procedures. Organizations can support business objectives through regulations and ensure operational resiliency by implementing elements of internal controls in their compliance program and regularly testing the effectiveness of specific internal controls linked to compliance.

Companies that want to foster this symbiotic relationship between Internal Controls and Compliance can embed those essential components from the process design phase.

Benefits of integrating Internal Controls and Compliance in the process design

There are many benefits to embedding internal controls and Compliance into your organization's processes, including but not limited to the following:

- Avoid regulatory fines and reputational damages.

- Reduce the cost of compliance activities throughout the organization.

- Lower costs in internal audit preparation and fees

- Operational cost reduction as a result of standardization

A proactive approach allows the organization to function at a higher level and quickly respond to compliance incidents throughout the organization without significantly disrupting the enterprise. This also allows the organization to quickly meet regulatory and compliance requirements and benefit from holistic oversight over the entire enterprise.

Key functionalities required in a system leveraging internal controls and compliance

Managing regulatory compliance with a software solution can increase efficiency and ensure compliance with your business objectives, policies, and procedures. There are some key functionalities a software solution should cover to ensure compliance while improving employees' efficiency:

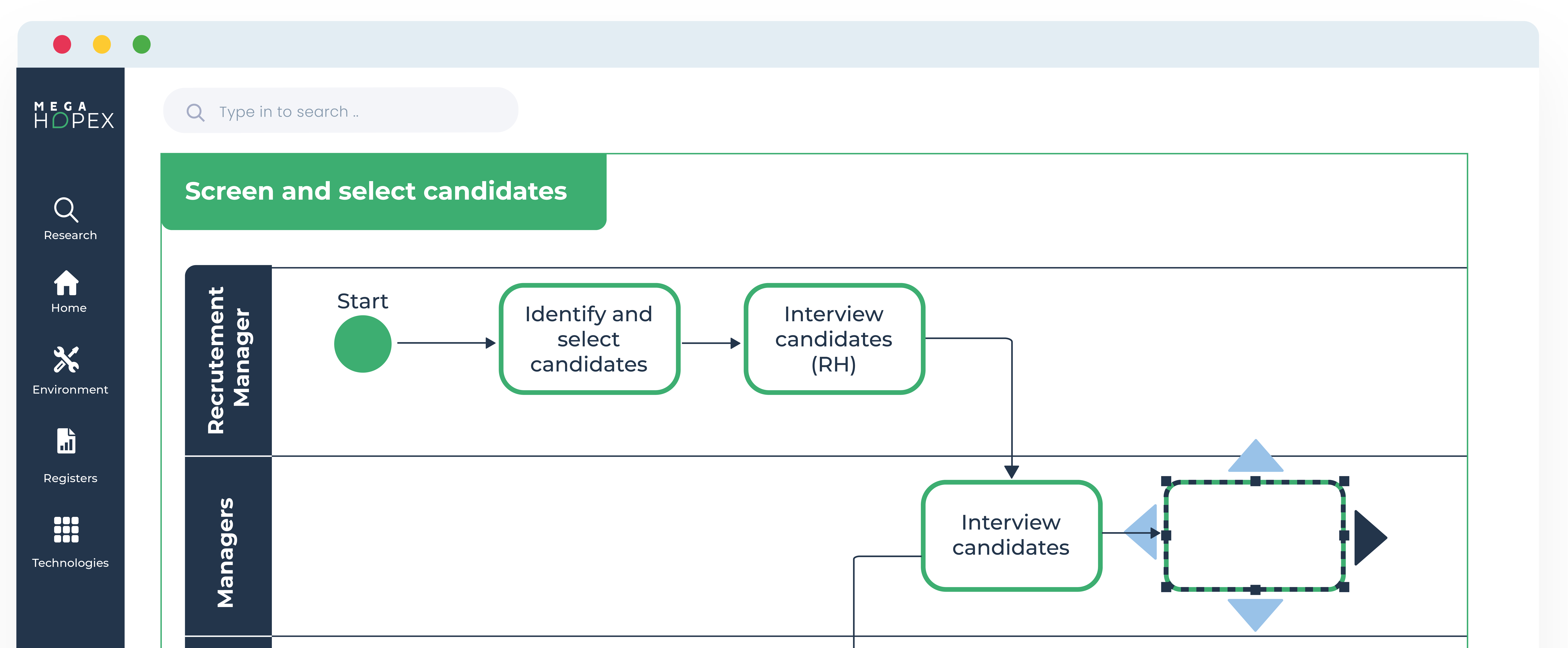

- Business process modeling. Define your business processes and model how they function to understand how your organization operates.

- Regulation mapping on processes. Map your regulatory obligations to your business processes. Knowing what business processes need to be reviewed is easier when a regulation changes.

- Central repository to store policies and regulations. Once you understand your processes and the regulatory obligations they have to meet, you can now write the policies and procedures to govern those processes and store them in a central repository accessible to all stakeholders.

- Regulation mapping on risks and controls. Map your regulatory obligations and policies to your risk and internal control register. Visualize how compliance controls effectively cover the risks of failure to adhere to regulations and policies.

- Compliance assessment engine. Next is ongoing monitoring and assessment of the compliance controls to ensure that business processes conform to regulatory requirements and procedures.

- Monitoring and notifications. Regulations are constantly changing, and you need to monitor regulatory change in the context of business operations and processes to notify the right stakeholders if new internal controls need to be implemented or processes modified to meet new requirements.

- Audit trails. Provide regulators and management with full traceability on compliance initiatives and actions.

Learn more about Business Process Compliance

FAQs

Business process compliance is critical to ensure compliance because it helps organizations maintain regulatory compliance, adhere to compliance standards, and ensure process compliance. Compliance may involve complex processes and various compliance regulations, which can be effectively managed through well-defined business processes.

Business process management improves efficiency by streamlining workflows, identifying bottlenecks, and optimizing resource allocation. Organizations can achieve higher productivity, reduced costs, and improved customer satisfaction with well-designed and implemented business processes.

Compliance management ensures process compliance by establishing a management system that aligns with an organization's business goals and regulations. It involves implementing policies and procedures, conducting audits, and using compliance management software to monitor and enforce compliance.

Compliance helps with risk management by identifying and implementing controls to mitigate potential compliance risks. By ensuring compliance with regulatory requirements, organizations can minimize legal and financial risks, maintain a positive reputation, and create a culture of integrity.

Compliance management challenges include keeping up with evolving compliance laws, ensuring internal compliance across departments, managing complex processes, and integrating compliance into existing business workflows. However, these challenges can be overcome efficiently with the right tools and strategies.

Business process compliance ensures transparency by establishing clear guidelines and standard operating procedures. With process compliance, organizations can monitor and track each process step, making identifying any non-compliance issues easier and maintaining internal and external transparency.

Compliance is crucial in change management, ensuring that any new process or change implemented follows compliance regulations. Compliance helps organizations accelerate change management by minimizing risks associated with the changes and ensuring all stakeholders know the compliance requirements.

Organizations can ensure process compliance by establishing a compliance management system, implementing compliance standards, conducting regular audits, training employees, using compliance management software, and continuously monitoring and improving processes.

Compliance management software plays a significant role in ensuring business process compliance by automating compliance processes, centralizing compliance data, providing visibility into compliance status, and generating reports. It helps organizations efficiently manage compliance requirements and streamline compliance management efforts.

Some best practices for ensuring effective compliance management include conducting regular risk assessments, documenting and updating policies and procedures, establishing a compliance culture, providing ongoing training and education, leveraging technology, and continuously monitoring and evaluating compliance performance.

Related Content to Business Process Management

Get a clear understanding of how your operation runs, identify areas of improvement, and build scenarios to optimize and transform business processes;

MEGA HOPEX for BPM

Request a demonstration of HOPEX for BPM, and see how you can have immediate value of your projects.